Personal Insurance

Homeowners Insurance

Homeowners insurance covers damage to your home, property, personal belongings,

and other assets in your home. Your homeowners insurance policy may also cover

living expenses above your normal cost of living if a covered loss forces you to stay

elsewhere while your home is being repaired or rebuilt. It may also provide coverage for

accidents or injuries that occur in your home or on your property.

Auto Insurance

Auto insurance is a contract between you and the insurance company that protects you

against financial loss in the event of an accident or theft. In exchange for your paying a

premium, the insurance company agrees to pay your losses as outlined in your policy.

Umbrella Insurance

An umbrella insurance policy is extra liability insurance overage that goes beyond the

limits of the insured's homeowners, auto, or watercraft insurance. It provides an

additional layer of security to those who are at risk of being sued for damages to other

people's property or injuries caused to others in an accident. It also protects against

libel, vandalism, slander, and invasion of privacy.

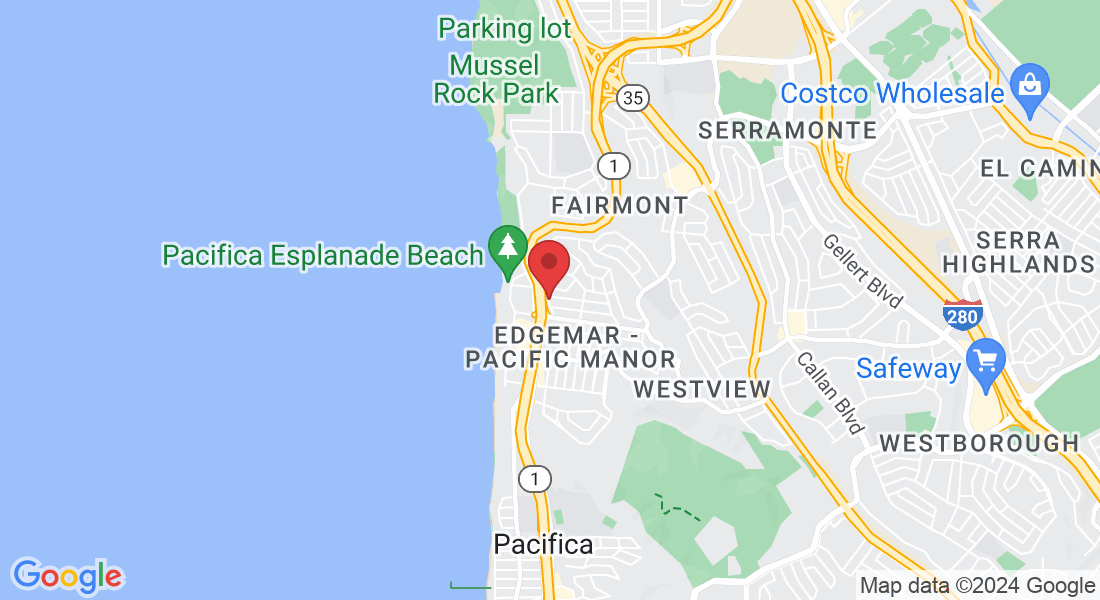

Earthquake Insurance

Earthquake insurance covers damage to your home, personal belongings and additional

living expenses if you need to temporarily live somewhere else after an earthquake.

Standard homeowners and renters insurance policies typically don't include earthquake

coverage, but you may add it to an existing homeowners insurance policy as an

endorsement or purchase it as a separate policy.

EPLI policies include or can include protection from Lawsuits and Claims for:

Flood Insurance

Flood insurance is a type of property insurance that covers a dwelling for losses

sustained by water damage specifically due to flooding. Floods may be caused by

heavy or prolonged rain, melting snow, coastal storm surges, blocked storm drainage

systems, or levee dam failure.

Boat Insurance

Boat insurance protects you financially from injuries or damage you cause to others

while boating. Insurance can also cover your watercraft and trailer if it gets stolen or

physically damaged. You can select and purchase additional coverages, such as

uninsured/underinsured boater (UB) coverage, to give you more protection on the

water.

Personal Articles Floater (Art / Jewelry / Collectibles)

A personal article floater policy is a type of inland marine insurance that may protect

readily movable property. The coverage travels or “floats” with the valuable items. It can

supplement your other standard insurance policies, such as a homeowners policy. A

personal article floater can be a separate policy or an endorsement from your current

insurer. A personal article floater is typically designed to provide “open peril” coverage.

This means that items will be covered unless explicitly excluded from your policy.

A policy Insures directors and officers of privately held companies against claims alleging mismanagement of the firm. Unlike publicly held corporations, the shares of privately held organizations are not traded on major stock exchanges. In addition, ownership is usually restricted to a small number of persons, typically the executives and managers who operate the company.

Let's get things started!

I agree to terms & conditions provided by the company. By providing my phone number, I agree to receive text messages from TAPD Insurance, Inc.